By: Brook D. Curtiss - Publisher

The Plainview Board of Education gathered for a special community meeting last Monday evening, working through some final recommendations to be made at the next board meeting in February for a possible school bond question.

The media center at the high school was standing-room only by the time the meeting began, with Board members, building committee members, bond representatives, architect staff and then residents that came to voice their opinion on the project.

Unofficial estimates included around 15 staff, 38 members and around 20 “officials.”

The entire meeting and presentation, including participation from the community and questions and answers can be found on the Plainview News YouTube Channel. A review of some of those questions may follow in the next week.

According to the minutes from the meeting, the Board will gather again at another special meeting, on Monday, Feb. 2 at 6 p.m. in the high school media center to “finalize bond resolution language and a date and time for the board to vote on such a resolution.”

The Feb. 2 meeting is earlier than the board’s normal “second Monday” monthly meeting, and at 6 p.m., instead of it’s normal 12 p.m. school tour meeting in Februarys. The minutes did not indicate if the second-Monday meeting would still occur or not.

According to the information at the meeting, a majority of the board must vote affirmatively to send language to the Election Commissioner for a May election by March 1.

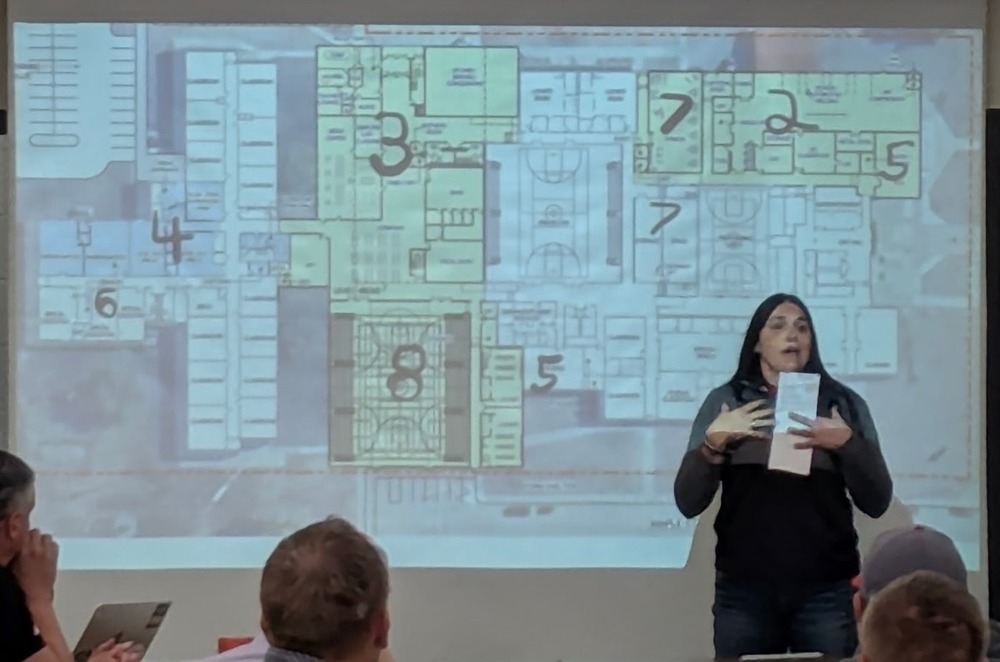

First up at the Jan. 19 meeting was the architecture firm, explaining meetings, school tours and surveys that were given to the staff, parents and others – and how the committee had worked through blueprints and alternatives to come to what was presented at the meeting.

Second the Plainview Schools administration – Elementary Principal Jen Hodson and Secondary Principal Kyle Schmidt took a turn at the microphone, to give some perspective on their thoughts of the needs of the project – focusing on travel inside the school, special education, consolidating classroom space inside the school, and the need for more “career technical readiness” and “life skills.” Schmidt indicated that some special education needs for the school range from “birth to 21 years of age.”

Estimated costs presented

Next was the financial representatives, explaining the costs, construction expenses and presenting three possible “tax impact charts.”

Though the board has the ability to pick any amount, any blueprint and any scope of the project, the “recommended” item from the committee presented at this meeting included a $32,500,000 bond.

In total, the financial presentation that was given included the following impacts:

Property Value, Cost/Year, Cost/Month

(Value as set by the County Assessor each year, subject to change.)

$100,000 property, $250.00 per year, $20.83 per month

$250,000 property, $650 per year, $52.08 per month

$500,000 property, $1,250 per year, $104.17 per month

Those estimates would be added to the totals already paid by the taxpayer, in round figures about 50% more than is currently paid. The current school levy stands around $0.526 cents per $100 of valuation, and this addition would raise it $0.25 cents

So, for the school’s tax request only, a $100,000 home would be $526.00 per year today, and if the bond passes in its entirety, those taxes would be $776.00 per year.

Extending that out to Agricultural property, the figures were changed to “per acre” numbers instead, with the entire project was estimated to add:

Irrigated, $12.19 per acre, $1,951 per quarter (per year)

Dryland, $10.87 per acre, $1,739 per quarter (per year)

Grassland, $4.12 per acre, $659 per quarter (per year)

A randomly chosen full quarter (160 acres) from a few miles outside of Plainview paid $6,218.50 in total tax for that quarter, and the additional could raise that bill to $8,169.50 per quarter. Values for land are very distinct for use, so numbers may vary.

Following information presented the bond as two “questions” – effectively separating the renovations and new construction, which still plans to close and build across the street – into two bond items.

The first would be $26,550,000 for the major renovation and repairs, and separating off the new gym/locker room at a second question of $5,950,000.

According to the conceptual budget – the new construction would be around $24 million at nearly $292.36 per square foot all said.

The documentation did not indicate if concrete outside for parking or any interior furnishings (desks/tables/etc) were included in the estimate.

All said, if the entire project is approved at $32,536,003 the cost per square foot would be near $400.

Survey conducted

In a “last effort” from the committee – the Board actually conducted a live survey during the meeting of those chosen building committee members, with the results presented at the meeting.

There was no indication about how many committee members were represented, or how many people voted on each item. The remainder of the audience was not polled.

Those results included (abbreviated questions):

Demolish 1920 building, 6 new classrooms, 2 wrestling practice areas: 100% agree

Demolish woodshop and construct new CTE/Skilled shop: 100% agree

Close Woodland Ave.: 93% agree

Repurpose kitchen/cafeteria for 3-4 year old preschool: 93% support

Construct new FCS/Culinary Arts – Level II/Life Skills area: 87% support

Repurpose space in elementary for Special Education, 87% support

Repurpose music room, construct new fitness room, repurpose existing weight room: 93% support

Construct new gym, 2 locker rooms, FEMA storm shelters: 73% support State of the School Figures considered Also included in the documentation at the meeting was the annual “state of the school” report calculated by Superintendent Dr. Darron Arlt.

Major trends showed:

* an increase in enrollment from 2016 from 315 students to 355 students in 2025 (12% increase)

* an increase in district property valuation from $746 million to $1.055 billion since 2022 (41% increase)

* a decrease in the levy from .663 in 2021-22 to .527 in 2025-26 (20.5% decrease)

* an increase in the budget from $4.77 million in 2019-2020 to $5.56 million in 2025-26 – nearly $1.1 million in the general fund alone, including the building fund fluctuations (averaging around $400,000 additional per year.) (16% increase)

* an increase in state aid from $44,560 in 2022-23 to $563,083 in 2025-26. (1163% increase)

* an increase in general fund disbursements from $5.05 million in 2019-2020 to $6.3 million in 2024-25 (a 24% increase)

* 15 students opting in to the district and 49 students opting out

* an average “cost per pupil” figure of $21,736, a bit lower than the chosen “array” at $22,401, but $6,000 higher than the state average of $15,899. A direct division of General Fund Disbursement ($6.309 million) by student population (355) was $17,772 per student.

Just for fun, the valuation per student in the school district is $2.971 million, and the cost per student in property tax request is $15,665.83.